Whatsoever may be in final release we will see at that time when finally it will be released. Lets look what is available in this preview.

Login to Madeira using your credentials.

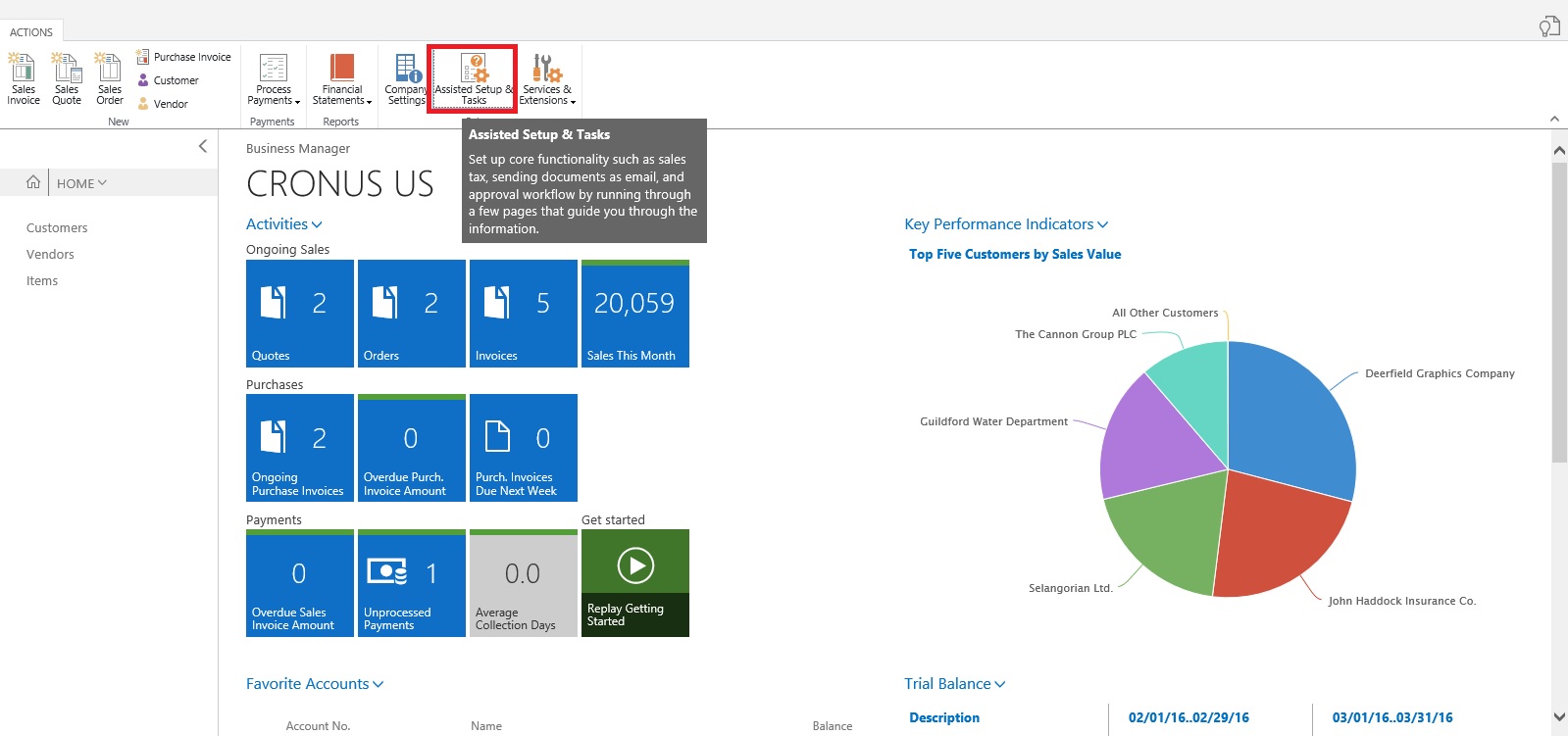

From Action Tab on landing/ Role Center Page on Ribbon click on Assisted Setup & Task.

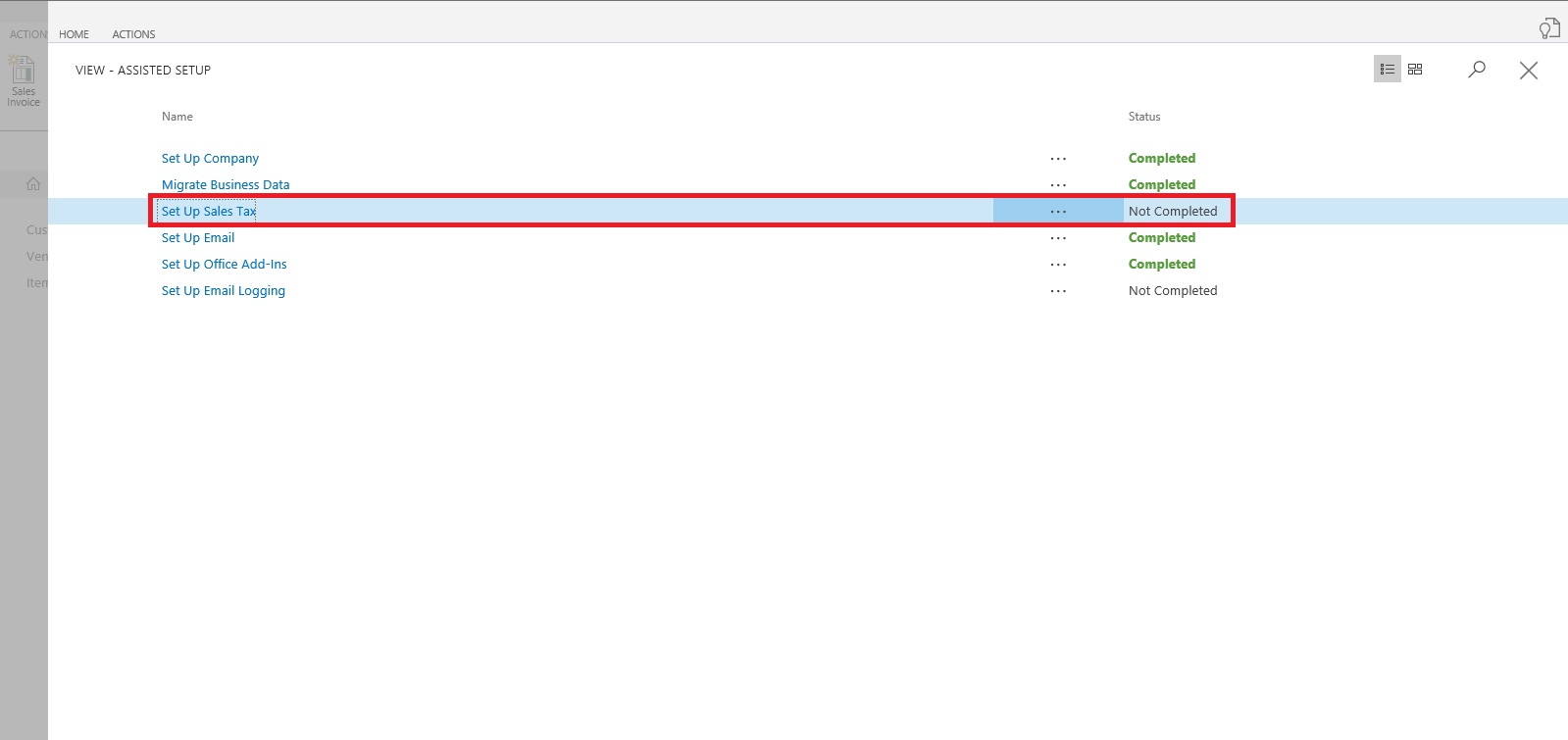

List with available options page is opened.

Select Setup Sales Tax to continue.

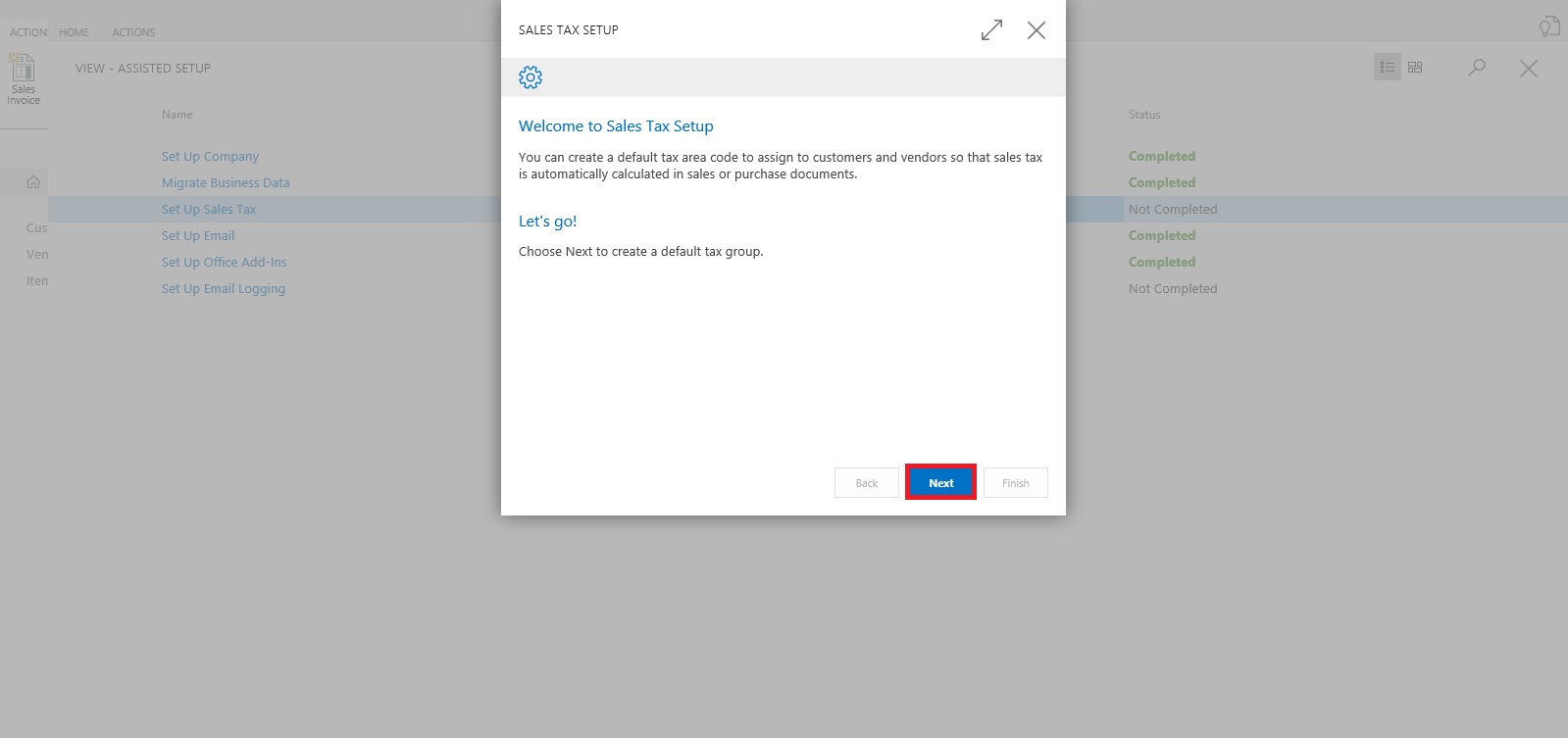

Welcome Screen appears click on Next Button.

Default tax group is created and you can start with other setup, click on Next.

We are only talking about Tax since this preview is only for US so options relevant to them only available.

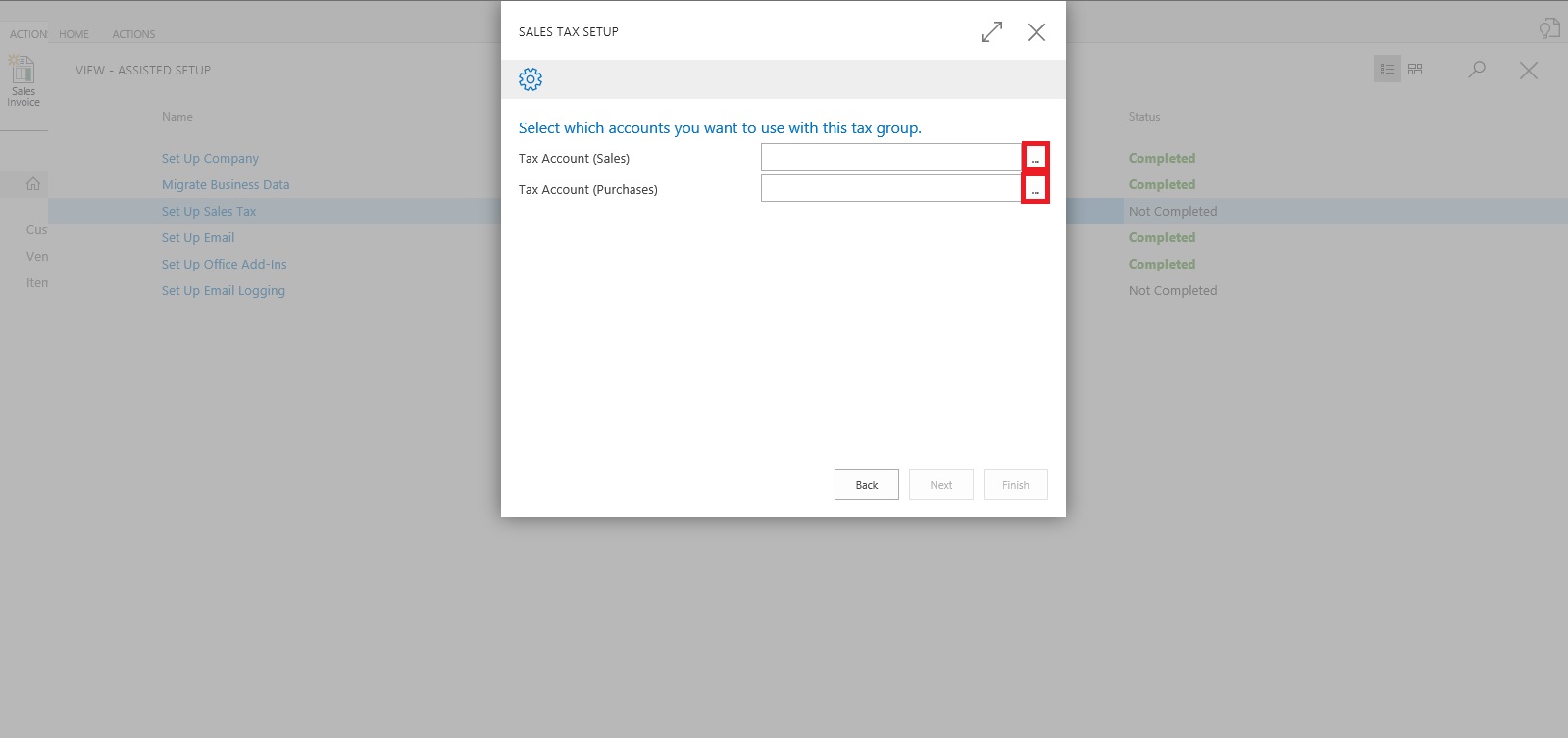

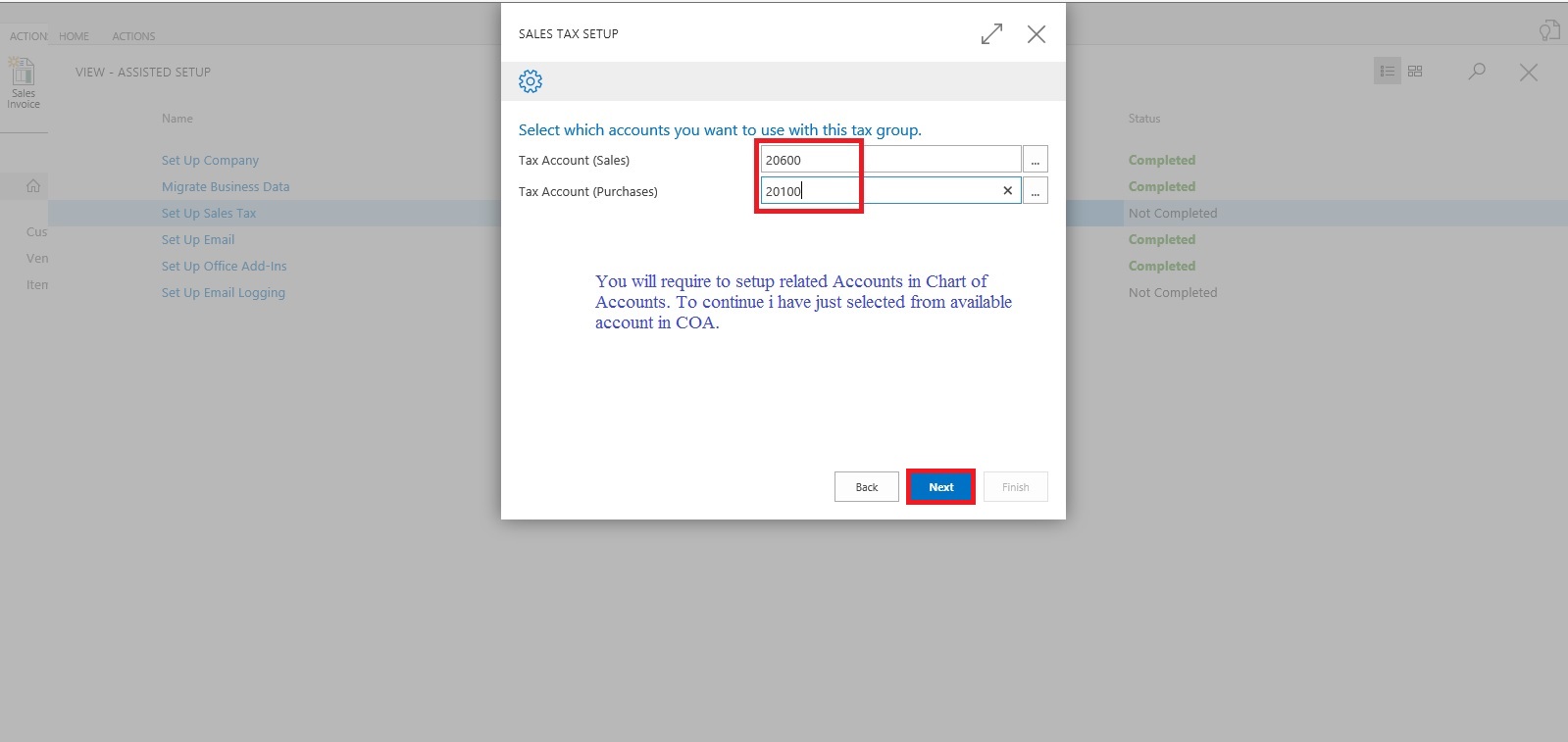

Select the Account for Tax Account (Sales & Purchase) using the Assist button which lists you the Available Accounts in COA.

Next City, Country & State related information need to be filled, and then click Next Button to proceed.

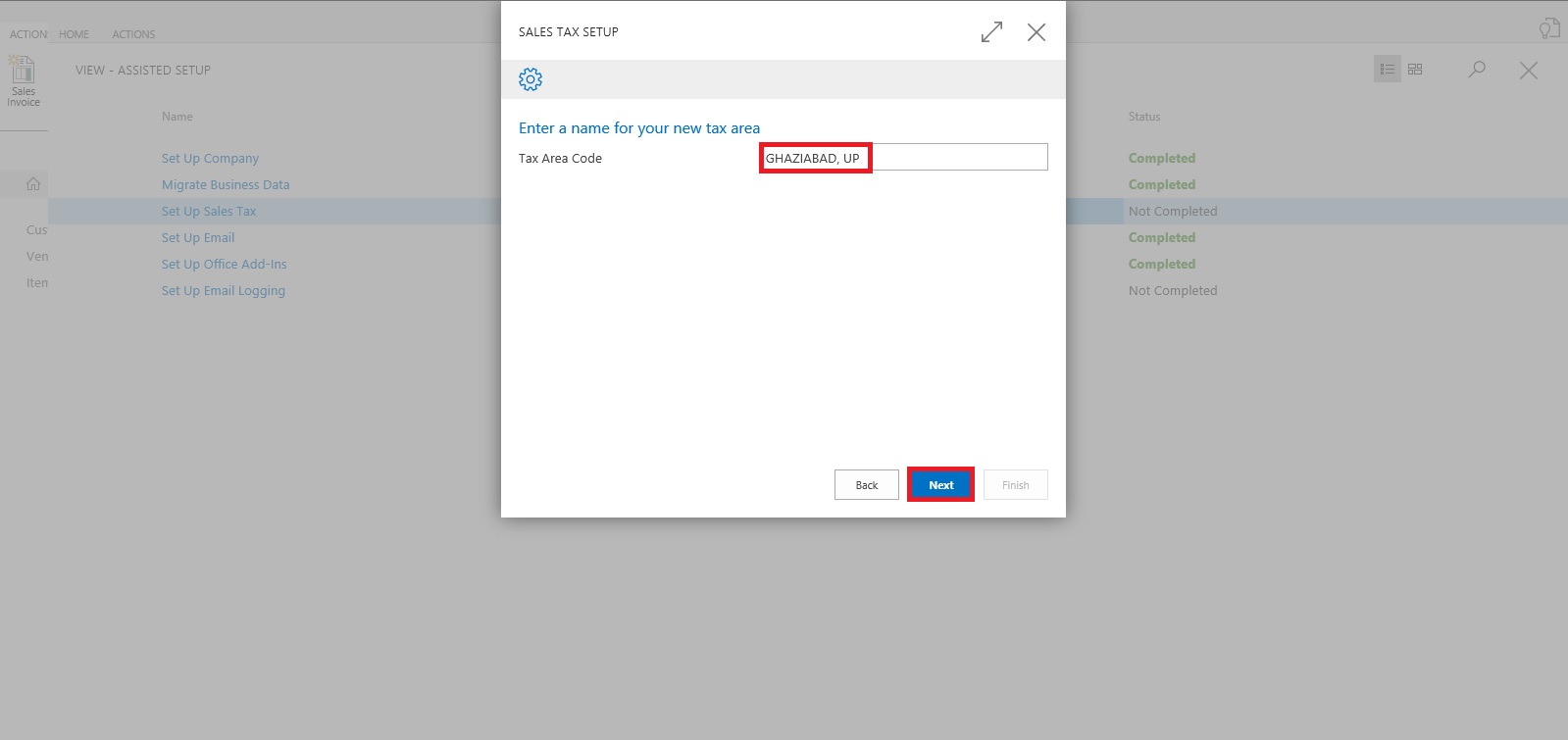

Depending upon Information provided in Previous Screen it suggests Tax Area Code, click on Next Button to continue.

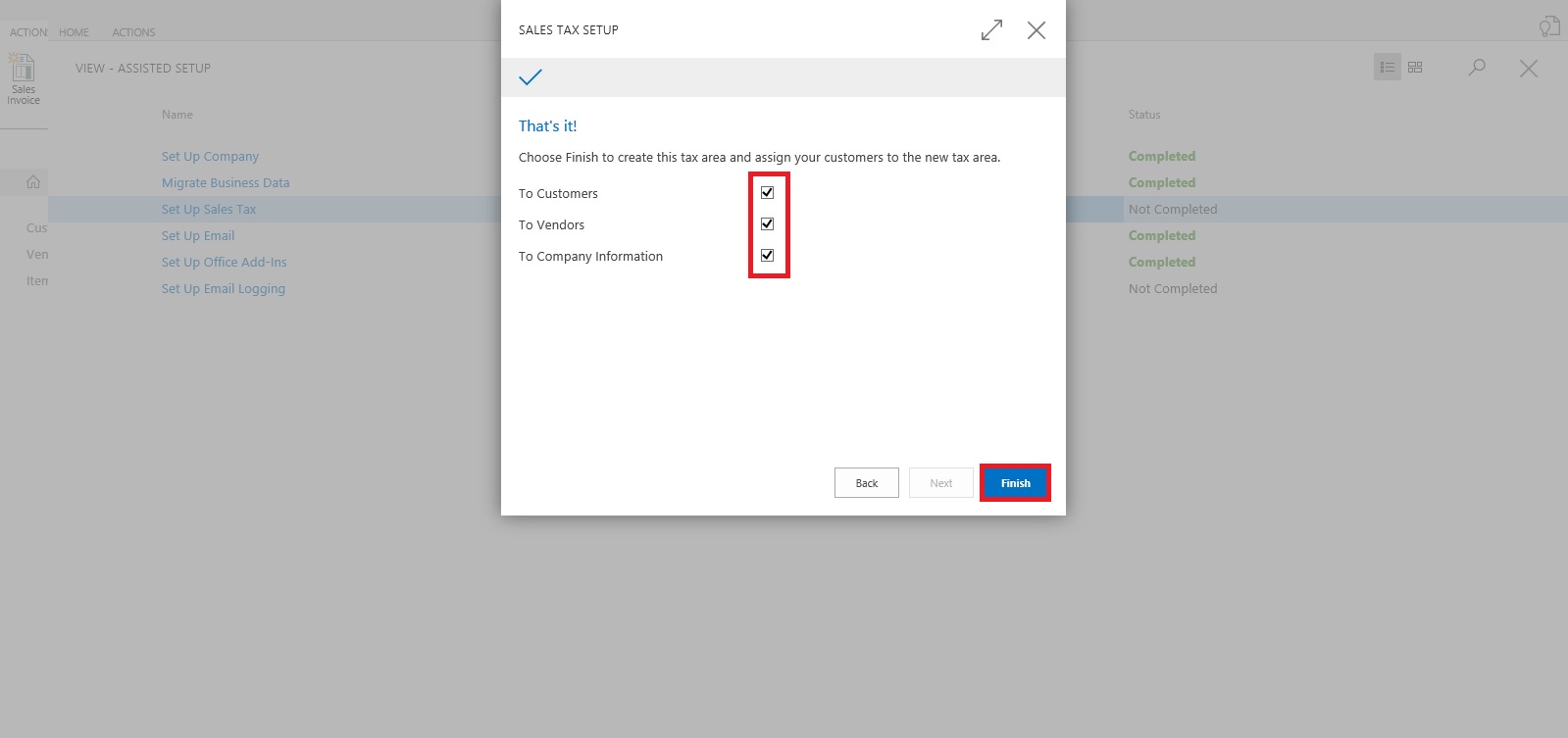

We are done with Setup now we will assign this to Customer, Vendor and Company.

Click on Next to continue.

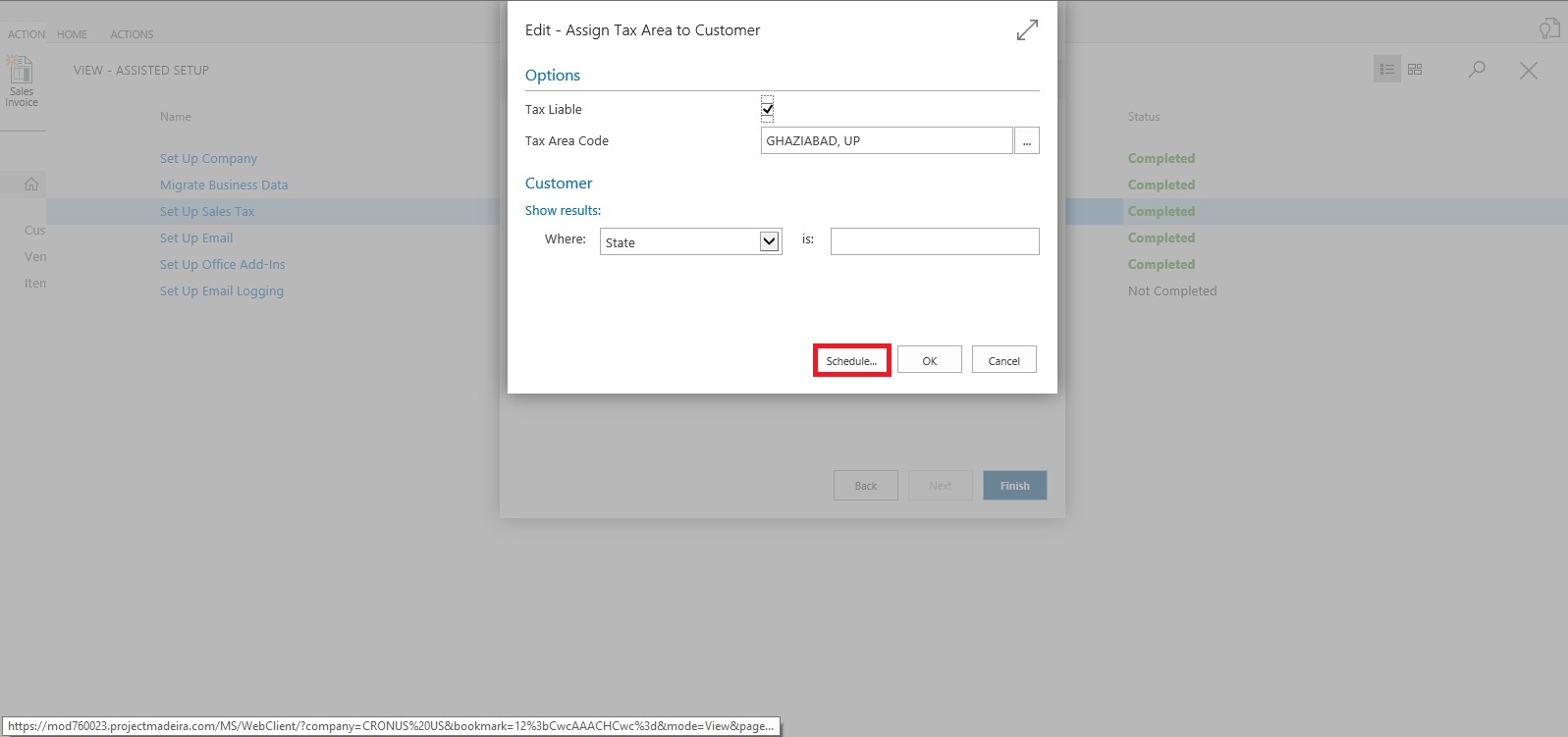

You can Assign the Tax Information to Customer as per entering simple query.

We can assign or we can leave this activity for later.

We have option to schedule a reminder for this activity. Click on Schedule to continue.

Enter the Date and Time for Start & Expiry of this reminder.

This will setup a Job for this and keep reminding you so that you have track of, that this activity is still pending and need to be completed.

Once done choose OK Button to continue.

You can see this in Jobs Entry Page.

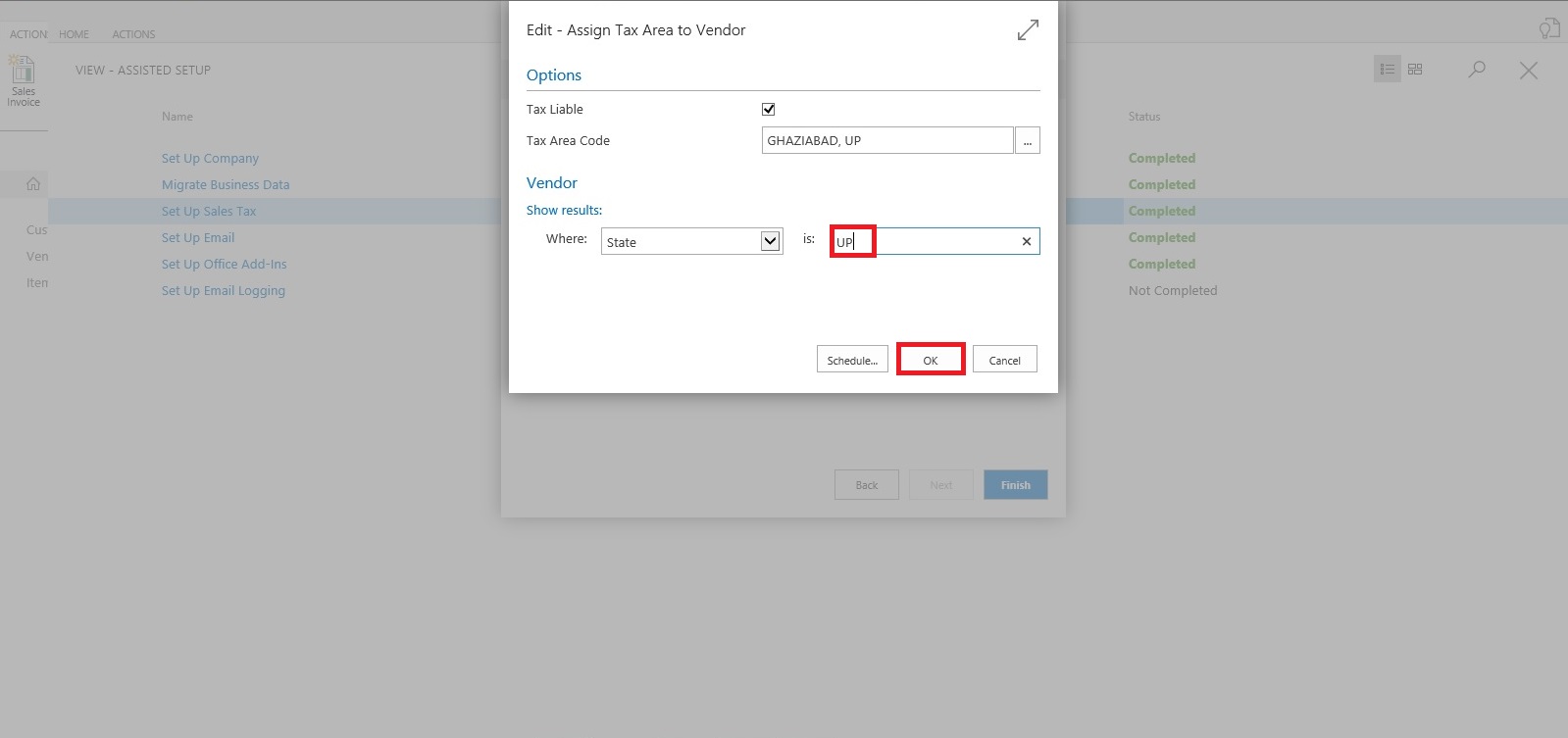

Similarly you can do for Vendor too.

For company it will be applicable if you selected, so no separate screen for same for query based assignment.

Select OK to Continue.

We are done with our Tax Setup for Company, Customer & Vendor.

That’s all for today, will come up with more information in my next post.

Till then keep exploring and learning.

No comments:

Post a Comment